Nurturing in the life sciences—Part 2: 15 important reasons to nurture our prospects

By David Chapin

SUMMARY

VOLUME 8

, NUMER 4

There is a great deal of misunderstanding about nurturing prospects in the life sciences. In the last issue I outlined the framework within which our life science prospects need nurturing: the buying cycle with its four main stages. In this issue, I answer the question: Why should we nurture?, and lay out the many good reasons to nurture our life science sales prospects. I’ll also explain how the tactics (touchpoints) we choose will make a huge difference. Some touchpoints are eminently forgettable, so I’ll explore the “half-lives” of different touchpoints and offer guidance about which ones to use for buyers at different stages of the buying cycle.

Why do we nurture our prospects in the life sciences?

Buyers progress in distinct stages through the life science buying cycle for big-ticket items with long sales cycles. As we saw in the last issue, stage 1, Precontemplation, has the largest number of our life science prospects. These prospects see no need to change, so they just aren’t interested, period. Stage 2 prospects, Contemplators, are thinking about buying but aren’t yet serious. Stage 3 prospects, Planners (aka: Shoppers), are seriously thinking about buying. And stage 4 prospects, Buyers, are ready to isake a purchase. There is, of course, a fifth stage in the buying cycle: Sold. Our objective in nurturing in the life sciences is to help life science prospects navigate from whatever stage they currently occupy to this fifth stage.

All of the prospects in these different stages need nurturing, and the value of this model of the buying cycle is that it identifies the type of nurturing needed. Stage 1 life science prospects need nurturing in the form of education. Stage 2 prospects need nurturing in the form of inspiration. Life science prospects in stages 3 and 4 need reassurance, and since they’re so close to taking action, we typically refer to this as closing, rather than nurturing.

Is closing a form of nurturing?

As I noted in the last issue, the definition of nurturing is: the process of building a relationship with our life science prospects, one that allows us to guide their transition from one stage in the buying cycle to another. Despite this broad and useful interpretation, most of us still think of nurturing as actions that are directed at those prospects not yet ready to buy, in other words, life science prospects in stages 1 and (mainly) 2. But prospects in stage 4 need guidance as we manage their transition from stage 4 to its ultimate conclusion—purchasing—so closing is actually a form of nurturing as well.

I don’t want to quibble over terminology, but this is a common misperception; most of us think of nurturing only as certain activities aimed at prospects in a certain stage (stage 2, Contemplation). You’re thinking of nurturing too narrowly; I want you to think more broadly.

Nurturing applies even to anonymous prospects in the life sciences.

So my first point is this: Nurturing in the life sciences applies along the entire buying cycle, from Precontemplation to Sold. And my second point is related: We can nurture people we don’t know. In fact, we must structure our nurturing efforts to include people that we don’t know—those anonymous prospects that have a need for our products or services right now, but who have not yet “raised their hands” and identified themselves to us.

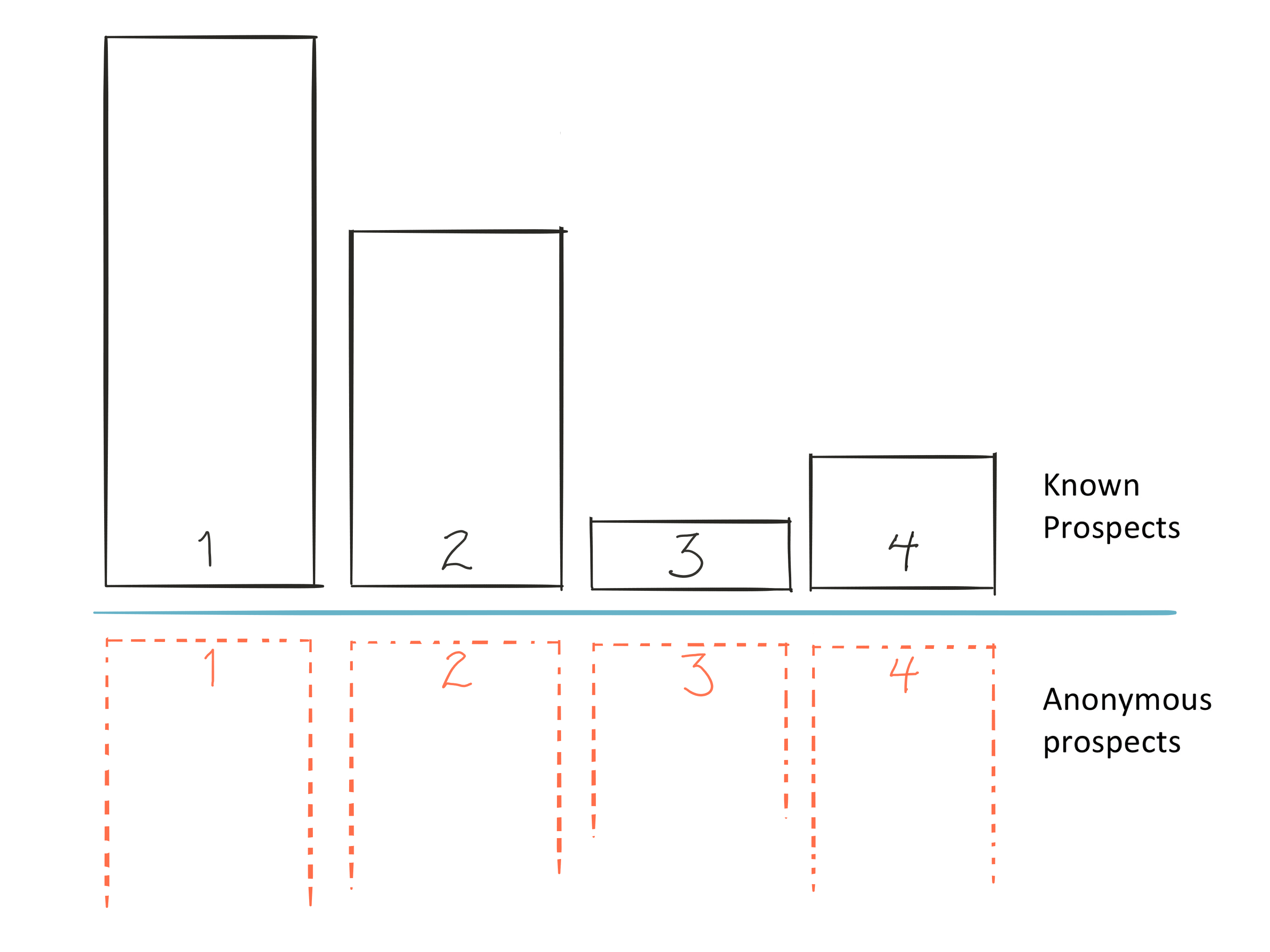

Figure 1 illustrates these two classes of prospects: first, those whose name, company and email address we know, and second, those who are unknown to us. As prospects become known to us, we typically learn their name, company and email first. Once they become known we qualify them, that is, we determine which stage of the buying cycle they’re in. Then we can decide whether we should jump on a plane this very minute, or sign them up for our monthly whitepapers.

We must structure our life science nurturing efforts to accommodate these initially anonymous prospects, because it’s entirely possible that the number of prospects that are anonymous is much larger than the number of prospects we have in our database.

Figure 1: Some prospects are unknown to us; they’re somewhere in the buying cycle, but we don’t know where. Some prospects are known to us; we know something about them, such as their name, email, company, and/or their stage in the buying cycle.

The size of each rectangle is roughly proportional to the number of prospects in each stage. We typically have the most prospects in stage 1, followed by stage 2. Prospects remain in stage 3 for a very short time, so we have the fewest prospects in this stage. Because anonymous prospects are just that—anonymous—we don’t know how many prospects are in each stage.

We must nurture both our anonymous and known prospects. Nurturing known prospects Involves outreach appropriate to the stage of the buying cycle they occupy. Nurturing anonymous prospects cannot be targeted at specific individuals; we can only make information available to people who are searching for an appropriate solution.

But I haven’t yet answered the core question: why should we nurture our prospects? It turns out there are 15 very good reasons.

1. Why nurture? Because life science sales are complex (and slow).

Most of the life science products and services I write about are complex and expensive. And complex offerings imply complicated purchase decision-making processes. A complex decision often means a longer decision cycle; there are more things to consider and more judgments to make and more people to involve. All of these factors mean that life science buyers don’t (or can’t) make a purchase decision while the sales person is in the room. They’ve got to think about it and consult with colleagues and make plans and get budgets approved. We nurture our prospects to assist them through the entire complex buying process.

2. Why nurture? Because buying in the life sciences doesn’t always proceed linearly.

Buying decisions, particularly buying decisions that have to be made by large teams, tend to progress in fits and starts. Buying teams shift direction. Criteria change; deadlines get altered. Now, if we’re calling our life science prospects every Monday, then on Monday (and maybe Tuesday) we might know exactly where they are in the buying cycle. Of course, I’m sure they’d find our frequent outreach incredibly annoying. By Wednesday, how do we know what progress they’re making on their buying decisions, or where they are in the buying process right now? Let’s face it: five minutes after we hang up from our latest phone call, we really don’t know where they are in the buying cycle. The VP could have just walked into the room and with a few words stepped on the accelerator pedal or hit the brake. We wouldn’t know.

Depending on the technology we use to do our nurturing, our activities may or may not give us a better view of where exactly our life science prospects are in the buying cycle. What our nurturing should do is give us the ability to reach them no matter where in the cycle they are. In this sense, nurturing makes us more nimble; whatever they need, we’re ready for them. With a life science buying process that can proceed in fits and starts, we nurture our prospects to help them through the buying cycle, no matter their velocity.

3. Why nurture? Because life science prospects have too much choice.

Prospects have too much choice; millions of search results are available in a fraction of a second. This abundance of options means that life science prospects can get most, if not all, of the information they need without talking to our salespeople. When they have questions, they won’t call us. In fact, they might change their minds and choose someone else, and we wouldn’t even know until it was too late.

How do we make ourselves truly one in a million? Consider the rank in search engine results. The top position is highly coveted not only due to the increased traffic received, but also because the top result looks like the most obvious (and by implication, best) choice. Getting to the first position requires that we give away fresh, organized, unique, relevant content—that is, that we nurture Google itself with content, because Google is exactly one of the touchpoints we need to nurture our prospects. We nurture to help us look like the obvious choice to our life science prospects.

4. Why nurture? Because the life science customer isn’t always right.

There is an old saying: the customer is always right. I don’t agree; you’ve likely seen this cliché disproved in your career as well. But while life science customers will be wrong sometimes, they will still always be the customer. Similarly, a buyer isn’t always right; in fact, with their lack of current knowledge and experience, they’re often wrong. This can manifest itself in a couple of ways. First, they can be misinformed about the best solution for them. That is, they might be trying to buy the wrong thing. Second, they can be misinformed about the best process to use in buying; life science buyers don’t always know how to buy.

Nurturing can help us address both of these issues. The proper nurturing program can seed life science buyers with information that they can use during the buying cycle. Since most prospects are in stage 1, what they really need is education. They’re not yet ready for sales efforts, and we’ll destroy our reputation if we come on too strong. We nurture to help our life science prospects ask the right questions, be open to the most appropriate answers and follow a process that makes sense for them.

5. Why nurture? Because nurturing helps us stratify our life science prospects.

We nurture to help and support good prospects; w also nurture to identify which life science prospects are the good ones—that is, the ones that are in the later stages of the buying cycle. As we saw in the last issue, prospects can remain in stages 1 or 2 for years; not every prospect needs the same amount of attention right now. Nurturing allows us to help our life science prospects without spending an inordinate amount of time on each one. Nurturing can help us identify which phase of the buying cycle each prospect is in and lets us focus our valuable and limited time on the prospects that are in the later stages of the buying cycle. I’ll talk about how this happens in a later issue. We nurture to help those life science prospects that are the most likely to buy.

6. Why nurture? Because it takes at least 7 touches to close a life science sale.

I can’t find the origin of the “7 touches” rule, or any serious data to back it up. However, if you think about your last ten sales, I bet each involved a lot more than 7 touches. We nurture to increase our contact with our clients as they traverse the stages of buying.

7. Why nurture? Because it’s more efficient.

Nurturing an existing life science lead to a successful close is much more efficient than finding a new lead. We nurture to save ourselves money and time.

8. Why nurture? Because our life science prospects might need us 24/7/365.

The pace of life has increased. Our clients are busy and are probably working at all hours. We nurture to enable us to be there for our life science prospects, answering questions on their schedule, not on ours.

9. Why nurture. Because we’ll build trust and reputation among our life science prospects.

In most cases, nurturing involves an exchange of value with our life science prospects. We provide thought leadership and in return we get an enhanced reputation. This exchange precedes the exchange of value we really desire, the actual sale. Because life science sales cycles are typically long, we have to get to the sale by first exchanging value with our prospects. We do that by nurturing them.

As a result of this exchange through nurturing, we’ll get an enhanced reputation and increased trust—but only if our nurturing activities are oriented around educational insight, not sales fodder. “To make the best buying decision, buy from us!” is not education, it’s sales, and it won’t nurture our prospects. In contrast, “As you consider your options, here are 12 things you may not know,” can be much more helpful to a prospect, and enable us to build trust and credibility. The more we provide thought leadership that is unique and valuable, the more we’ll build trust with those in the earliest stages of the life science buying cycle.

We nurture to build our reputation as knowledgeable, helpful and informative. We nurture to be seen as trustworthy.

10. Why nurture? Because our life science competitors are nurturing our prospects.

Our life science competitors are nurturing their prospects. This is a safe assumption, since nurturing is what high performance organizations do. Don’t believe me, go visit their web sites. See any whitepapers, or webinars, or infographics? That’s for nurturing prospects. Since we’re competing for business, their prospects are our prospects. If we don’t nurture them, we’re giving our competitors a head start in the race to close the clients that should be ours. Think back to the actual conversation with which I started the last issue. Someone very high up in the sales function inside a world-wide, well-known life science organization reported that the sales team did very little nurturing, instead giving their prospects everything they could as soon as they determined that the prospect might be interested in buying something, someday. I don’t have a problem with making information available, but this organization is missing a major opportunity by neglecting any disciplined follow-up. This behavior leaves this organization vulnerable to a life science competitor that takes a more organized approach to nurturing, reaching out on a more frequent basis.

11. Why nurture? To build our habits of nurturing our life science prospects.

There’s nothing wrong with making a great deal of information available to prospects at all stages. But giving everything away at once leaves us very little ammunition for nurturing our life science prospects next month, next quarter or next year. We’ll think, “Well, I already sent them that,” so we won’t be likely to send them anything else.

But if we begin to nurture our life science prospects, we’ll get better at nurturing. If our entire process is predicated on a single data dump, and then we learn something new or interesting later on, we won’t be in the habit of sharing that expertise with our prospects (and we’ll miss an opportunity to stay on their radar screens). We nurture to get better at nurturing. Perfect practice makes perfect.

12. Why nurture? Because life science sales cycles are long and prospects’ memories are short.

When buying cycles are long, prospects forget. They forget we exist, they forget what we sell, they forget why we’re different, they forget why we’re better. Do you remember every phone call you took three weeks ago? How about every white paper you read two months ago? Of course not. Neither do your prospects. We nurture to stay top of mind for our life science prospects.

13. Why nurture? Because our internal life science champion needs help.

Complex sales and large buying teams often end up with internal champions, guiding the group decision (in the way they want it to go). These internal champions can use all the help they can get. We nurture to help our cause by helping our internal champions, giving them the ammunition they need to convince others.

14. Why nurture? Because all life science sales and marketing activities have a half-life.

In chemistry, half-life is the time required for any specified property (e.g., the concentration of a substance in the body) to decrease by half. This concept has been adapted to consumer marketing and sales. For example, the half-life of a catalog is the time (counting from the mail date) at which half the orders have been received. The half-life of a tweet is the time from the first posting to the point at which half of the retweets have appeared. This measurement is useful because it allows us to compare similar touchpoints. But this measurement adopts the point of view of the touchpoint in question (the substance, the catalog or the tweet).

There is another way to look at this; we can take the point of view of the recipient. At some instant in time (measured from exposure to the touchpoint) half the recipients will no longer remember (or be affected by) the touchpoint; at this point, we can say the half-life has been reached. Different touchpoints have different half-lives for different people. Your wedding has a very long half-life for you and your spouse, but its half-life is much shorter for the attendees who were sitting in the back, waiting for the reception to start and the bar to open.

All marketing and sales activities in the life sciences have a half-life; different touchpoints have different half-lives. Do you remember all the text messages you got in the last six hours? With some work, you probably could. How about all the text messages you received seven days ago? No, of course not. So, empirically, the half-life of a text message seems to be somewhere between six hours and seven days.

You probably remember the main points of a book you read 30 days ago, but most of the time you don’t remember the ones you read two years ago. I’d guess that fewer than half of us do. The half-life of a book seems to be somewhere between 30 days and two years.

I’d like to propose the scale shown in Figure 2, in which touchpoints are ranked according to their half-life, as seen from the eyes of the recipients (our audiences). This table is organized using the ladder of lead generation, which is shown in the two left-hand columns.

| Rung on the Ladder of Lead Generation | Touchpoint | Minutes | Hours | Days | Weeks | Months | Years |

| Earned exposure | Reputation | ||||||

| Book | |||||||

| Podium presentation | |||||||

| Testimonial | |||||||

| Content marketing | White paper | ||||||

| Webinar | |||||||

| Blog post | |||||||

| Tweet | |||||||

| Paid exposure | Web Site | ||||||

| Brochure | |||||||

| Ads | |||||||

| Personal interactions | Capabilities presentation | ||||||

| Phone call | |||||||

| Voice mail message | |||||||

Figure 2: The half-life of various touchpoints. The half-life is indicated by a shaded rectangle. Notice that higher rungs on the ladder of lead generation are populated with touchpoints that have longer half-lives.

Targeting our life science nurturing activities to the stage of buying

I am not suggesting that the half-lives I’m including in the table above are accurate to within six decimal places. Nevertheless, the table is instructive. There are two points I’d like to draw your attention to. First, life science touchpoints have different half-lives; some are remembered for much longer periods than others. Second, touchpoints that are located higher on the ladder of lead generation generally have longer half-lives.

The ladder of lead generation is organized with short-reach, fast-acting touchpoints at the bottom and far-reaching, slower-acting touchpoints at the top. When it comes to nurturing, life science prospects generally feel that activities at the top of the ladder of lead generation are more important, more credible and therefore more worthy of their attention than activities at the bottom. Given how different rungs on the ladder of lead generation have different reach and speed of action, we should tune the activities we use to the different stages of the buying cycle in which we find our life science prospects.

Life science prospects that are just about to make a purchase decision (that is, prospects in stages 3 and 4) need nurturing that is fast-acting, so we must use touchpoints from the bottom of the ladder. And prospects that won’t be making a decision for weeks or months need nurturing that has staying power, i.e., touchpoints that have a long half-life. We find these touchpoints at the top of the ladder.

I have long said that high-performance life science marketing teams must create campaigns that use multiple touchpoints across the entire Ladder of Lead Generation. And now the reason should be clear: by using the entire ladder, we can address all of our life science prospects, regardless of where they are in the buying cycle. We need to nurture our prospects where they are—that is, according to the stage of the buying cycle they occupy. Making all our touchpoints available allows prospects to engage with the touchpoints that they will find most beneficial (and therefore remember the most).

| Rung on the ladder | Touchpoint | Reach | Speed of Action | Best for prospects in stage… |

| Earned exposure | Reputation Book Podium presentation Testimonial |

Broadest | Slowest | 1 Precontemplation 2 Contemplation |

| Content marketing | White paper Webinar Blog post Tweet |

Broad | Slow | 1 Precontemplation 2 Contemplation 3 Planning |

| Paid exposure | Web Site Brochure Ads |

Broad | Faster | 1 Precontemplation 2 Contemplation 3 Planning |

| Personal interaction | Capabilities presentation Phone call Voicemail Trade shows |

Narrow | Very fast | 3 Planning 4 Action |

Figure 3. Different activities should be used to nurture prospects in different stages of the life science buying cycle. Activities at the top of the ladder will generally be “on demand,” that is, available on the prospect’s timetable. After all, they can watch a recorded speech or webinar at 3:00 in the morning, if it suits their schedule. Activities at the bottom of the ladder tend to be scheduled for mutual convenience.

Life science prospects in stages 1 and 2 are best nurtured with activities from the top two rungs of the ladder of lead generation: content marketing and earned exposure. Prospects in stages 3 and 4 can best be nurtured by activities from the bottom two rungs of the ladder: paid exposure and personal interactions.

15. Why nurture our prospects in the life sciences? Because it works.

Let’s end with the single most important reason to nurture our clients: Nurturing helps our life science prospects buy—in other words, nurturing helps us navigate opportunities to a successful close. As we’ve seen, closing a deal is a multi-step process, and our life science buyers need different types of support as they traverse the buying cycle. Nurturing does exactly this: it supports buyers as they transition from one stage in the buying cycle to the next, and the next, and the next.

Even better? Lead nurturing is proven to drive results. In a recent study of large-ticket B2B sales opportunities (2014 Lead Nurturing Benchmark Study published by DemandGen), 67% of B2B marketers say they see at least a 10% increase in sales opportunities through lead nurturing, with 8% seeing opportunities increase by 30% or more.

These data are clear, and they are not unique. There are many other studies that show that lead nurturing brings results. For example, The Annuities Group reports that nurtured leads make 47% larger purchases than non-nurtured leads. Nurturing can indeed drive closing opportunities—but only if we perform it correctly. And to understand how lead nurturing should work, we have to understand the journey our prospects go through as they buy, and how we can support them on this journey.

Why do we nurture our life science prospects?

Why do we nurture? We nurture to assist our clients and prospects in making the right decisions as they traverse the buying cycle. We nurture to form and foster relationships. We nurture to drive results. We nurture to close deals.

In our next issue, I’ll discuss some of the technology available to help us nurture our prospects. I’ll look at the interaction of the seven big components of a nurturing ecosystem and I’ll detail the progression of a typical life science organization as it evolves from a simple and haphazard approach to a more disciplined, effective solution.

The Marketing of Science is published by Forma Life Science Marketing approximately ten times per year. To subscribe to this free publication, email us at info@formalifesciencemarketing.com.

David Chapin is author of the book “The Marketing of Science: Making the Complex Compelling,” available now from Rockbench Press and on Amazon. He was named Best Consultant in the inaugural 2013 BDO Triangle Life Science Awards. David serves on the board of NCBio.

David has a Bachelor’s degree in Physics from Swarthmore College and a Master’s degree in Design from NC State University. He is the named inventor on more than forty patents in the US and abroad. His work has been recognized by AIGA, and featured in publications such as the Harvard Business Review, ID magazine, Print magazine, Design News magazine and Medical Marketing and Media. David has authored articles published by Life Science Leader, Impact, and PharmaExec magazines and MedAd News. He has taught at the Kenan-Flagler Business School at UNC-Chapel Hill and at the College of Design at NC State University. He has lectured and presented to numerous groups about various topics in marketing.

Forma Life Science Marketing is a leading marketing firm for life science, companies. Forma works with life science organizations to increase marketing effectiveness and drive revenue, differentiate organizations, focus their messages and align their employee teams. Forma distills and communicates complex messages into compelling communications; we make the complex compelling.

© 2024 Forma Life Science Marketing, Inc. All rights reserved. No part of this document may be reproduced or transmitted without obtaining written permission from Forma Life Science Marketing.