Is it time to rebrand your life science organization, product, or service? Part five: The rebranding process (steps 1-5 out of 10)

By David Chapin

SUMMARY

VOLUME 7

, NUMER 5

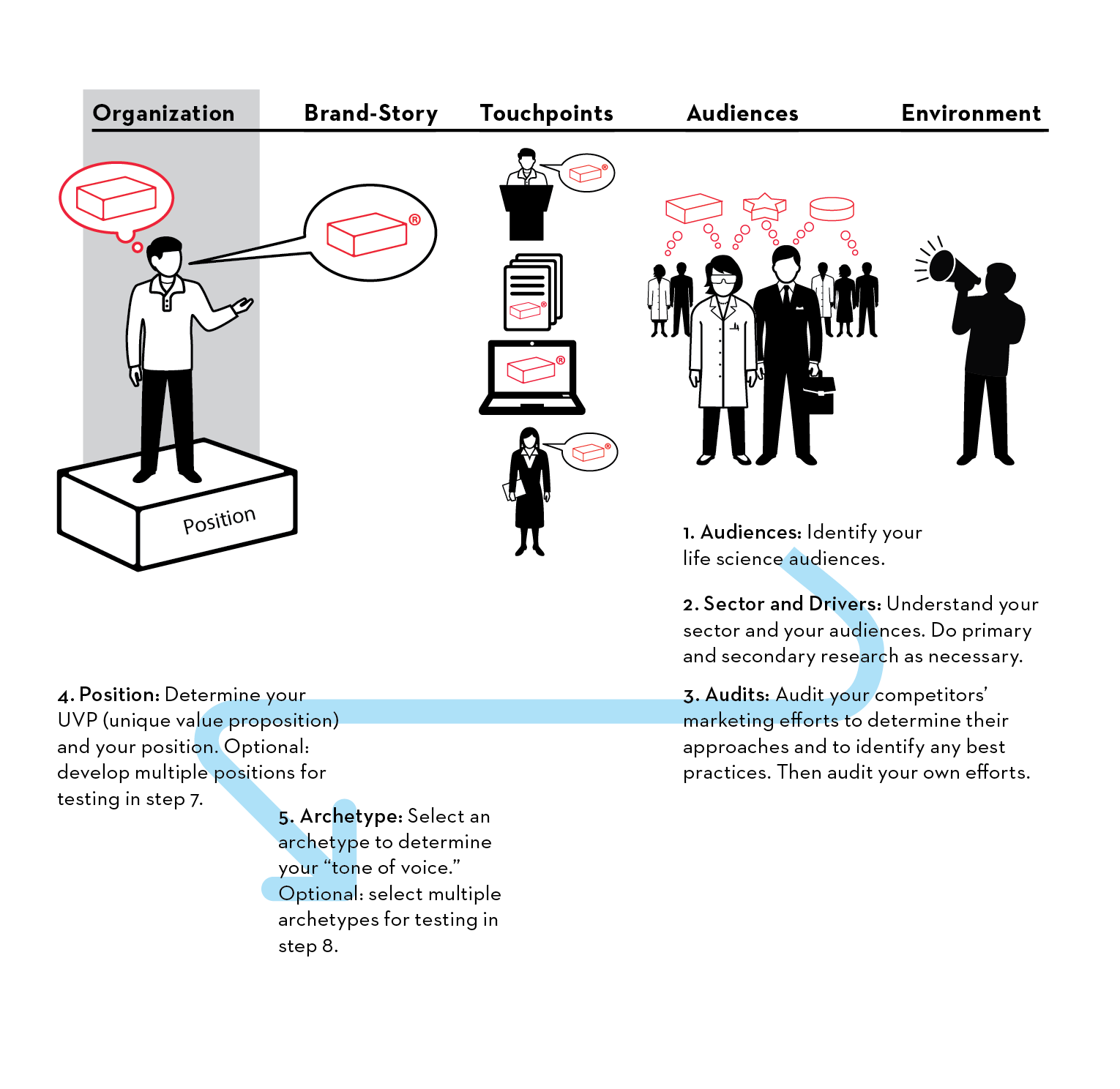

In this issue, I examine the process of rebranding. I’ll outline the first 5 steps in the rebranding process for a life science organization, product or service. Once you’ve decided to rebrand, you should begin by developing a clear-eyed understanding of your environment, your audiences and your competitors. Then you must select a position and an archetype.

Rebranding in the life sciences.

In the past 4 issues, I’ve covered many aspects of rebranding and repositioning in the life sciences, including:

- Confusion around the terminology. I believe the word “rebranding” is a red herring. There are four separate meanings to this word, and in most cases, organizations that consider rebranding should really be thinking about repositioning. Read more in the first of this series on rebranding in the life sciences.

- There are many factors that should or might give rise to a rebranding discussion inside a life science organization. Once the discussion starts, you should drive the focus upstream by asking whether your position is sufficiently defined. You can read more in the second issue.

- Assembling the team to guide your rebranding effort requires care. The right roles, attributes and skills must be present. You can read more about assembling the proper team in the third issue.

- How do you decide what path your organization should follow? Should you do nothing, begin a new campaign, just “rebrand” or reposition? A decision tree guides you through all the different aspects of these decisions in the fourth issue.

The ideal rebranding process in the life sciences.

If you’ve made it to this point—started the discussion, assembled the team, made the decision to move forward—now what happens? What should the ideal rebranding process look like? In this issue and the next I’ll provide a blueprint that you can apply to your own life science situation.

I’ll outline this step-by-step process with the assumption that you need to undertake not just a rebranding but a repositioning as well. Why? Because so few life science organizations, products or services have positions that are clearly defined. Having a position that is unique, important, believable and compelling is the first—and most important—step. Creating a new brand-story is worthless without a meaningful position; re-positioning must come first and “rebranding” should follow that. To see what a clear and useful definition of a position would look like, you can read more here.

I’ll describe the process as if you were going to complete every step, even though resource constraints may prevent you from doing so. Still, it’s nice to have the ideal plan laid out.

Figure 1. This diagram describes the first five steps in an ideal rebranding and repositioning process. Each of the steps relates to one of the five components of the Marketing Mechanism of Action: Position, Brand-story, Touchpoints, Audience and Environment.

Step 1: Identify your life science audiences before rebranding your life science organization

In a previous issue I outlined the importance of identifying your audiences precisely. You can read more here, but a brief recap is in order.

- You don’t have one audience; you have many audiences, including non-human, silicon-based audiences such as Google.

- Shoppers and buyers are retreating into the anonymity of the Internet.

- Audiences are losing their attention span, which narrows the gate through which they’ll let you approach.

- Many life science audiences believe themselves immune to marketing (even though there is peer-reviewed research to prove otherwise).

Once you identity your audiences, you must determine what drives their decisions. It is helpful to create personas to characterize your different audience segments; these personas will define and document the role each different type of buyer will play in the buying process and their buying triggers.

Step 2: Do your research before you rebrand your life science organization

There are three common types of research you can perform as you go through the rebranding and repositioning process. (We’ll talk about the third type—message research—in step 8.) At this point you can ask two different sets of questions: about the specific life science sector and about your audiences.

Secondary research can provide insights into sector issues, including—but not limited to—the following:

- What is the addressable market? What is the market segmentation, size, growth, trends, etc.?

- Who (specifically) are your competitors? How, and how well, are they competing? This includes competitive assessments, and can reveal their focus, value proposition, strengths and vulnerabilities, etc.

- What are the trends in the sector? What will change in three to five years: regulations, technology, audience expectations, etc.?

Primary research will connect with individual prospects and customers to provide insights into issues including—but not limited to—the following:

- What are the key drivers and preferences in purchase behavior?

- How are these drivers ranked by different sectors of the audience?

- What is the relative perceived rank of current competitors, including your own offering?

In addition to these two more formal types of research, it is wise to probe within your own life science organization. Frequently there is a great deal of accumulated wisdom inside life science organizations. For example, the sales force typically has a great deal of insight into audiences and competitors. Significant insight into the future of the sector and trends can come from people involved in strategy and planning (in larger organizations) or people involved in regulatory or c-level functions (in smaller organizations).

Gathering this information can be time consuming, but it is well worth it. For larger organizations, online surveys of the sales team can work well. In smaller organizations, interviews can reveal significant insight. I suggest that you schedule these interviews two-three weeks ahead of time, along with a request for the respondent to use that time to recognize and document specific issues, so they can come to the meeting prepared for your questions. I’ve found the quality of answers to questions such as: “What will this sector look like in five years?” to be significantly higher if the respondent can think about their answer for more than just a few minutes.

Taken together, these research findings will give you an overview of the context in which your unique value must compete for your life sciences audiences’ attention and trust.

Step 3: Conduct external and internal audits before you rebrand your life science organization

Conducting an external audit: To understand how your life science prospects see their array of choices, you must audit all the publically available marketing of your top competitors. You’ll start with their web site, of course, but you’ll want to use other sources as well, such as trade show appearances and presentations, national publications (for articles), brochures your sales people may have picked up, YouTube or Vimeo channels, LinkedIn, Twitter, etc. You’ll be amazed what you can uncover with a little sleuthing.

To document your efforts, create a table like that shown in figure 2, which is built around the Ladder of Lead Generation. It is all too easy to be inconsistent when conducting this type of audit; having some structure will bring discipline to the process and ensure you don’t omit something important.

Audit each of your major competitors in turn, looking at their presence on all the rungs of the ladder of lead generation. I’ve started to fill out the table in figure 1, to illustrate the type of information you are looking for.

| Rung on the ladder | Competitor 1 | Competitors 2,3,4,5 … | Your own marketing |

| Earned exposure | |||

| Articles published in national trade publications | None can be found | ||

| Press releases | Extensive list on their website. Frequency: approx. 3/month | ||

| Podium opportunities | None can be found | ||

| Content marketing | |||

| Video | Separate channel on Vimeo, with multiple videos | ||

| Whitepapers | Dozens on their web site; all are gated | ||

| Blog posts | None | ||

| Webinars | 1-2 per year; all are gated | ||

| Podcasts | None | ||

| Access to content | Typically gated | ||

| Well-maintained company page | |||

| Intermittent | |||

| Earned Exposure | |||

| Website | The site is very deep in certain areas. The user interface is clunky. This is likely due for an update soon | ||

| Brochures | None are available for download | ||

| Email campaigns | Frequent | ||

| Advertising, print | See attached list of pubs and sample ads | ||

| Advertising, online | A few banner ads | ||

| Personal interactions | |||

| Sales presentations | None available | ||

| Tradeshow booth | Typically a 10′ x 20′ booth. See attached list for the shows they attend | ||

| Inferred marketing strategy | |||

| Inferred Unique Value Proposition | Rapid delivery of the widest range of reagents | ||

| Inferred position | We’re the supplier with the broadest selection | ||

| Inferred archetype | The Servant |

Figure 2. This table is built around the Ladder of Lead Generation. Use this table to document the audits you perform on your competitors and then on your own marketing efforts. (Note: the word “gated” in the content marketing section refers to whether the content is available to the public without supplying identifying information, such as an email address.)

As you examine each competitor, look for patterns and trends. Is there something one competitor does that stands out; for example, are they the ones that use infograhics really well? If you make a discovery about something that’s not included in the table—such as “infographics”—go ahead and add it in the left hand column, and check other competitors’ performance in this area.

The goal of this exercise is to develop a complete view of each of your life science competitors’ marketing efforts, as seen from the view of a potential customer. Along the way, you want to make several judgments:

- How consistent are your competitors’ marketing efforts? This applies to something as trivial as “Do they always use the same font?” to something as subtle as “Do they use the same tone of voice in all marketing messages?” Consistency is one of the marks of a professionally run and effective marketing effort.

- How broad is their array of touchpoints? A competitor with a broader array of high-quality touchpoints is harder to compete against.

- How targeted are their individual touchpoints? Every organization has multiple audiences, and organizations vary in their approach to targeting them. Some will use a single message for all audiences; some will use different messages for different audiences. Understanding how your competitors are communicating is vital to comprehending the competitive landscape.

After the audit is complete, use all the knowledge you have gained and try to infer the following for each competitor:

- Their unique value,

- Their position and

- Their archetype.

These are private, of course; they won’t state them specifically on their web site. You’ll have to infer these, but if they’re doing a good job with marketing, the unique value and their position should be fairly easy to discern. While you are paying attention to their unique value and the position, it is worth noting how consistent their position seems to be. A competitor that expresses the same position across all touchpoints is doing a good job teaching their audience exactly what they stand for You can learn more about inferring their archetype here.

Conducting an internal audit: After your external audit is complete, you should audit your own marketing performance, using the same process. You should wait to complete your own audit until you have completed your competitors’ audits because as you examine your competitors, you’ll be building a list of common approaches and looking for best practices (e.g., infographics). If you do find any best practices, you want to use these efforts as a yardstick to measure your own.

You’ll have access to information from your own life science organization that won’t be available from your competitors, such as your sales presentations, proposals and contracts, unique value proposition statement, position statement and archetype toolkit. Don’t ignore this private information, or take this opportunity for granted. Conduct your review with the same zeal you would if you were seeing this information for the first time.

When you’re done, ask yourself how you compared to your competitors? When conducting these types of audits, I frequently find a few areas of strength combined with significant areas that need improvement. This should indicate that the path you are on—repositioning and then rebranding—is a necessary and wise one.

Step 4: Clarify Your Position as you rebrand your life science organization

At this point, you’ve determined where your particular life science sector is headed; what the audience finds important, believable and compelling; how your competitors are attempting to attract, nurture, inspire and reassure buyers in the sector; and how your own marketing compares to these competitors.

Thus ends the diagnostic phase of your life science repositioning and rebranding effort. Now you must venture into the prescriptive phase, and clarify/define your own position.

Your position is the DNA that will guide your marketing efforts for years to come. Your position will reference your UVP (unique value proposition) and it must meet seven key criteria: clear, unique, authentic, sustainable, important, believable and compelling.

I have written extensively on the topic of positioning here and here. I suggest you read these issues and then complete a positioning statement, using this template as a guide.

If you are planning to conduct audience research later in the process (step 8), you can develop two or more alternate positions, and use your research to determine which is the most important, believable and compelling.

Step 5: Clarify your Archetype as you rebrand your life science organization

An archetype can be thought of as a “personality” that provides consistency and clarity to all your public-facing, life science marketing efforts. Examples include the Hero, the Lover, the Ruler, the Explorer; there are thousands of possible archetypes. Archetypes are a powerful way to manage the meaning and the personality of your brand-story. When archetypes are used effectively, they can lead to greater differentiation and pricing power.

The use of archetypes in life science marketing is quite new, and you can learn more by reading this series of whitepapers:

- Gaining differentiation (and pricing power) through the use of archetypes in life science marketing. Read more.

- Families of archetypes and their use in life science marketing. Read more.

- Archetypes in action in life science marketing. Read more.

- Choosing an archetype that will differentiate your life science organization — a ten-step process. Read more.

- Putting Your Archetype Into Action in Life Science Marketing. Read more.

Now it is time to select your archetype. This whitepaper provides a step-by-step process to make this selection.

The selection of your archetype will be closely linked to the selection of your position. Your position defines the attributes that make you unique from your competitors, attributes that relate in some way to the unique value you offer. Your archetype provides a consistent, defined “tone of voice” to use in publicly expressing the messages that articulate your position.

If you are planning to conduct audience research later in the process (step 8), you can select two or three alternate archetypes, and use your research to determine which is the most resonant with your audiences.

Conclusion

I’ve now covered 5 of the 10 steps required for rebranding in the life sciences. These first five steps are:

- Identify your life science audiences.

- Understand your life science sector and audience decision drivers by conducting research.

- Audit your competitors’ marketing efforts and then use what you learn as a yardstick to audit your own marketing efforts.

- Determine your UVP and position. As an option, you can choose to develop multiple positions to test later in the process (step 8).

- Determine your archetype and “tone of voice.” As an option, you can choose to select multiple archetypes to test later in the process (step 8).

In the next issue, I’ll outline the remaining steps in the process of rebranding.

The Marketing of Science is published by Forma Life Science Marketing approximately ten times per year. To subscribe to this free publication, email us at info@formalifesciencemarketing.com.

David Chapin is author of the book “The Marketing of Science: Making the Complex Compelling,” available now from Rockbench Press and on Amazon. He was named Best Consultant in the inaugural 2013 BDO Triangle Life Science Awards. David serves on the board of NCBio.

David has a Bachelor’s degree in Physics from Swarthmore College and a Master’s degree in Design from NC State University. He is the named inventor on more than forty patents in the US and abroad. His work has been recognized by AIGA, and featured in publications such as the Harvard Business Review, ID magazine, Print magazine, Design News magazine and Medical Marketing and Media. David has authored articles published by Life Science Leader, Impact, and PharmaExec magazines and MedAd News. He has taught at the Kenan-Flagler Business School at UNC-Chapel Hill and at the College of Design at NC State University. He has lectured and presented to numerous groups about various topics in marketing.

Forma Life Science Marketing is a leading marketing firm for life science, companies. Forma works with life science organizations to increase marketing effectiveness and drive revenue, differentiate organizations, focus their messages and align their employee teams. Forma distills and communicates complex messages into compelling communications; we make the complex compelling.

© 2024 Forma Life Science Marketing, Inc. All rights reserved. No part of this document may be reproduced or transmitted without obtaining written permission from Forma Life Science Marketing.